Prologue Document Introduction

Due to the origin of ETF products and futures, in order to better design Coin-Margined ETF products, this article will start from the introduction of Coin-Margined Futures and profit and loss calculation, then demonstrate the characteristics and trading logic of Coin-Margined ETFs through case studies, and finally briefly discuss the details of risk control such as margin maintenance and hedging.

- 1. Introduction of Coin-Margined Futures

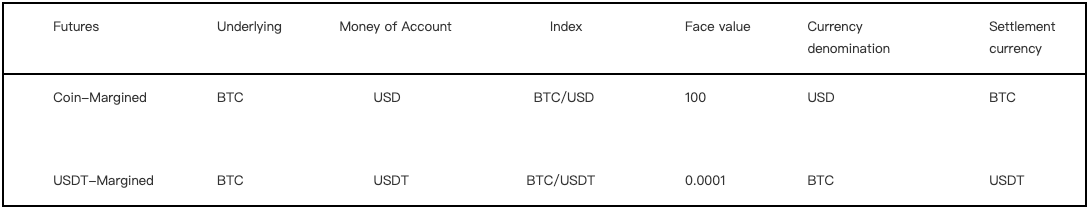

Coin-margined futures products are quite popular in the cryptocurrency market, and exchanges such as OKX are launching coin-margined futures first before the development of the USDT-margined futures. Generally, the former can be called an inverse contract and the latter a forward contract. Obviously, in order for market trading to be sustainable, traders should have equal gains and losses when performing the same operations on both coin-margined and USDT-margined futures, whether they are settled in USDT or coins.

However, since the margin for USDT-margined futures is in fiat currency, the margin for coin-margined futures is in cryptocurrency, in the case of a coin-margined, the current value of its margin is obviously influenced by the coin price. Then:

If the price of the currency goes up, the coin-margined futures must be making more money because the margin portion is converting to fiat currency and the money is getting bigger. If the price of the coin goes down, the coin-margined futures must lose more money, because the margin part is converted into fiat currency, and the money is getting less.

In the case of OKX's perpetual futures for BTC, it is the difference in the currency used for margin, i.e. the settlement currency, that ultimately leads to the advantages and disadvantages of each of the two futures and affects the outcome of the investment.

- 2. Profit and loss calculations

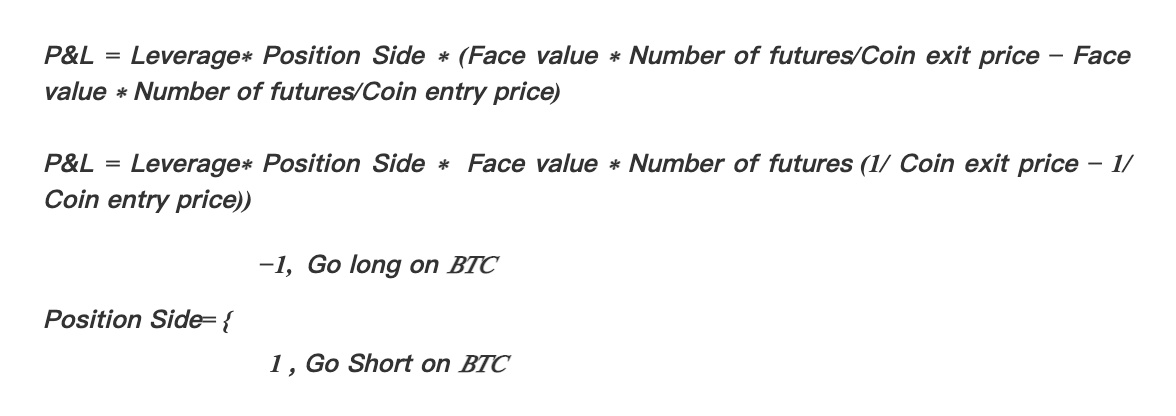

USDT-Margined Future is relatively simple to calculate profit and loss. As shown in Formula 1:

In the above equation, the face value multiplied by the coin price is actually equal to the price per future.

In the USDT-Margined futures, the face value currency is BTC, and BTC is bought and sold in USDT, therefore, the face value ∗ number of futures in the above equation is essentially the amount of BTC that can be exchanged for the equivalent USDT, and the face value ∗ coin price is actually equal to the price of each future. By multiplying the change in currency price by the number of futures according to the leverage and the position side, the profit and loss can be calculated, and the unit of profit and loss is USDT.

In Coin-Margined futures, it is relatively complex to calculate profit and loss. As shown in Formula 2:

In Coin-Margined futures, the face value is USD, and USD is bought and sold in BTC, where the price of USD relative to BTC is the reciprocal of the coin price. Thus, the face value ∗ number of futures in the above equation is essentially the amount of USD that can be exchanged for the equivalent BTC, and the 1/coin price is the price of USD in BTC terms. By multiplying the amount by the change in price according to the leverage and position side, the profit and loss can be calculated in BTC.

Looking at the two formulas, we know that under the USDT-Margined scheme, the face value ∗ coin price is actually equal to the price of each future; under the coin-margined scheme the face value∗ 1/coin price is actually equal to the price of each future. The two equations can thus be combined as follows.

It is important to note that the position side of the coin-margined future is the opposite of the USDT-margined future. This is because going long against BTC is equivalent to going short against USD and vice versa - which is where the directional future gets its name. As in Equation 3.

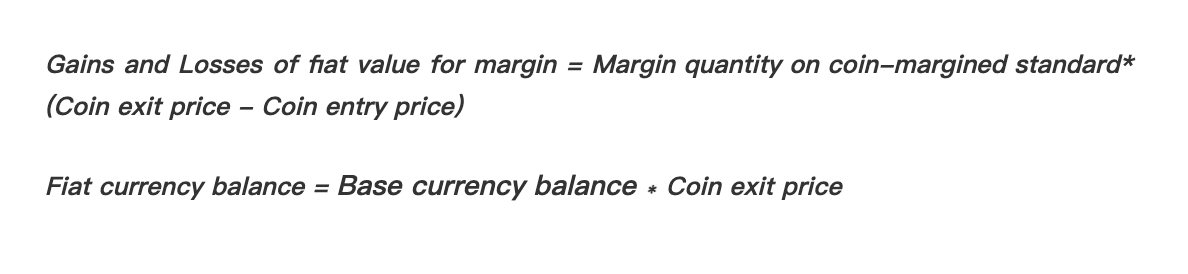

The profits and losses are the same whether operating on USDT-margined or coin-margined futures. However, due to the influence of coin price on the fiat value of margin under the coin-margined standard, the total return of fiat value brought by the transaction is different. The ultimate profit or loss for a trader under the coin-margined standard is the sum of the two gains and losses. As shown in Formula 4:

The following section will illustrate the difference by examples.

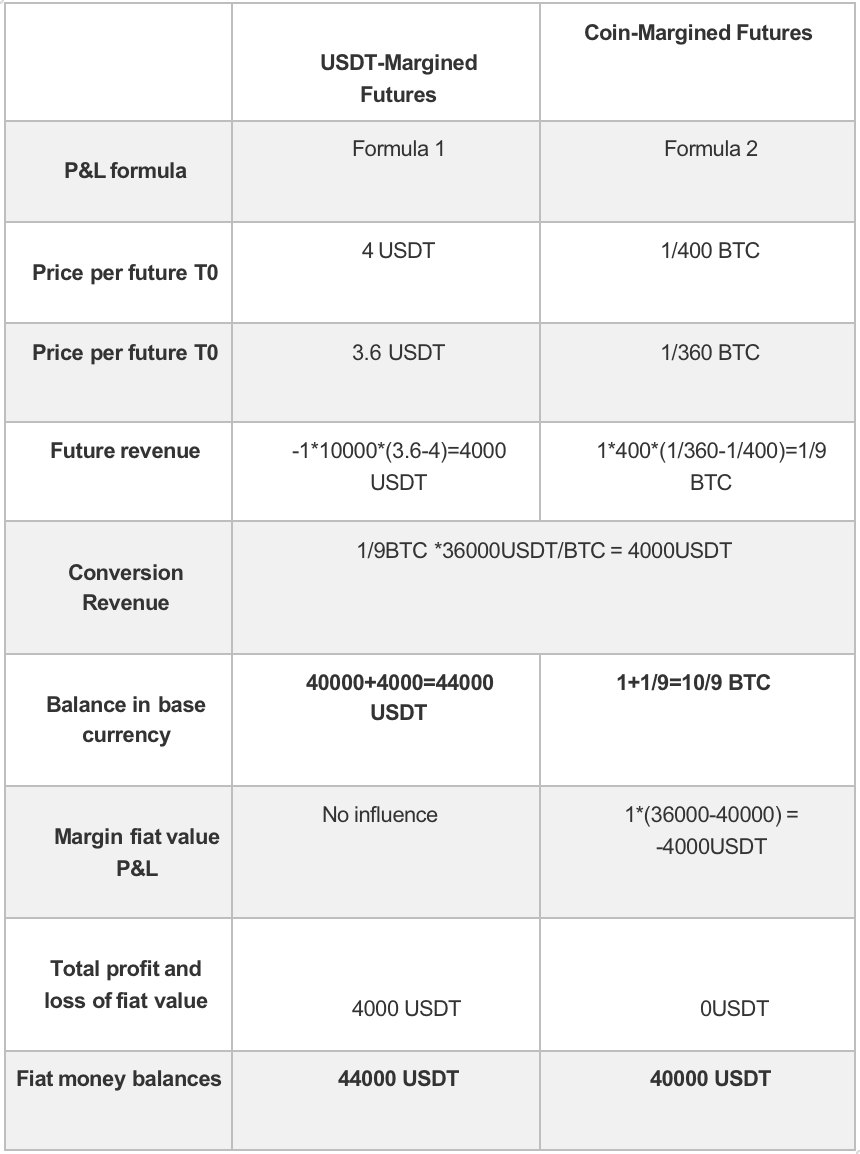

- 2.1 Case 1 Go Short situation

Assuming 1 USDT = $1, At a BTC price of $40,000:

The Coin-Margined Futures (inverse future): short 400 futures (face value $100) with margin of 1 BTC without leverage. USDT-Margined future (forward future): short 10,000 futures (face value 0.0001 BTC) with margin of 40,000 USDT without leverage.

Assuming a 10% drop in the price of BTC ($40,000 to $36,000), the comparison of returns is as follows:

It was found that although both positions earned $4,000, due to the drop in the price of the coin, the coin-margined futures earned 1/9 BTC, the total profit/loss in fiat value remained unchanged.

- 2.2 Case 2 Go Long situation

Assuming 1USDT=$1, at a BTC price of $40,000:

Coin-Margined contracts (Reverse contracts): go long 400 contracts ($100 face value) with five times leverage at 0.2 BTC margin. USDT-Margined contract (Forward contracts): go long 10,000 contracts (0.0001BTC face value) with five times leverage at 8,000 USDT margin.

Assuming a 10% increase in the price of BTC ($40,000 up to $44,000), the comparison of returns is as follows.

It was found that while both positions made $4,000, the coin-margined contract not only made 5/11 BTC due to the increase in the price of the cryptocurrency but also added $800 to the total profit/loss of the fiat value.

- 3. The Introduction of Coin-Margined ETF

3.1 Its relationship with contracts and profit and loss calculation

If contracts can be designed in coin-margined scheme, ETF tokens can also be designed on a coin-margined basis.

Similarly, when traders perform the same position side in coin-margined ETF and USDT-margined ETF, the gains and losses should be equal whether they are settled in USDT or coins. However, as the USDT-margined contracts are margined in fiat currencies, the coin-margined contracts are margined in cryptocurrencies, in the case of a coin-margined situation, the fiat value of the margin is affected by the coin price.

Thus: if the price of the cryptocurrency goes up, the coin-margined scheme must be making more money because the margin portion is converting to fiat currency and the money is getting bigger. If the price of the cryptocurrency falls, the coin-margined scheme must lose more money because the margin portion is converted into fiat currency and the money is getting less.

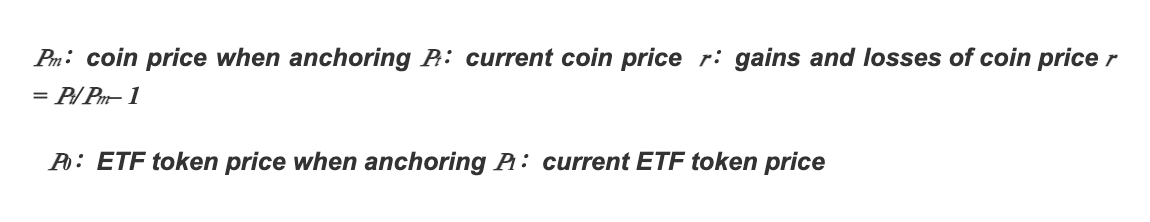

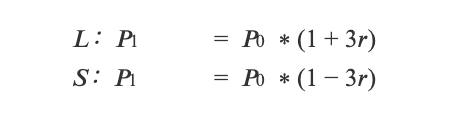

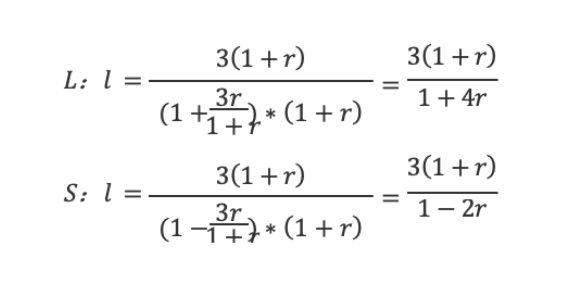

The calculation of token price under different schemes are as Formula 5 shows:

USDT-Margined

Thus, under USDT-margined standard, the gains and losses of token is ±3𝑟

Coin-Margined standarad

Thus, under Coin-margined standard, the gains and losses of token is ![]()

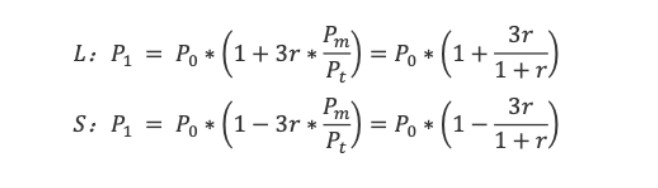

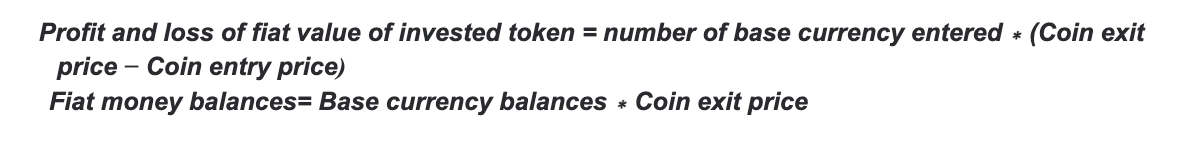

Since the price of ETF tokens considers leverage, position side and other factors when created, and it does not allow short position. Therefore, it is easier to calculate the profit and loss. No matter in USDT-Margined ETF or Coin-Margined ETF, the calculation is similar to Formula 3, which is constructed as Formula 6.

The profit and loss is the same whether you operate in USDT-margined contract or coin-margined contract. However, the total gain in fiat value from a transaction is different under the coin-margined standard due to the effect of the coin price on the margin fiat value. The ultimate profit and loss of a trader on the coin-margined standard is the sum of the two gains and losses.As in Equation 7

This difference will be demonstrated in Case 3 and Case 4.

There is no rebalancing factor in Formula 4 and Formula 5. Does this mean that rebalancing or not and the number of rebalancing does not affect the calculation of profit and loss?

Answer: No. Rebalancing does not directly affect the calculation of P&L, but is transmitted by affecting the token price. Therefore, all you need to know to calculate the profit and loss is the price of base currency and the token price.

This problem will be proved in Case 5.

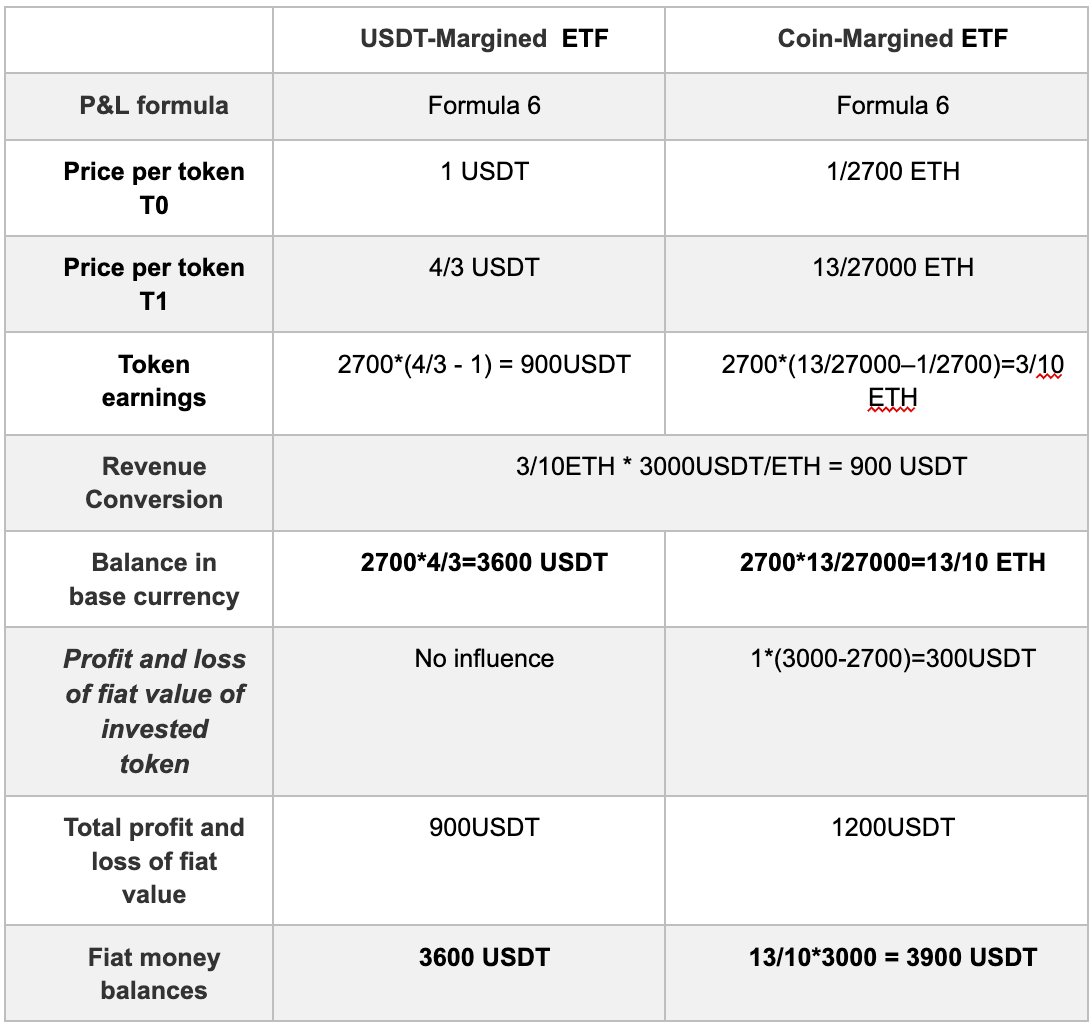

Case 3: The Right Position Situation

Assuming 1 USDT = 1 USD, at ETH price of 2700 USDT, 3L token price under USDT-Margined is 1 USD and under Coin-Margined is 1/2700 ETH:

Coin-Margined ETF: purchase 2700 3L tokens for the cost of 1 ETH (number = 1*2700/1=2700). USDT-Margined ETF: purchase 2700 3L tokens for the cost of 2700 USDT (number =2700/1=2700).

Assuming an ETH price increase of 1/9 ($2,700 to $3,000), the token price increase would be 1/3 in the USDT margined ETF and 3/10 in the coin-margined ETF

The comparison of returns is as follows.

It was found that at this point both positions earned $90, but due to the increase in the price of the coin, the coin-margiend ETF not only earned 3/10 of ETH, but also added 300 USDT to the total profit/loss of the fiat value.

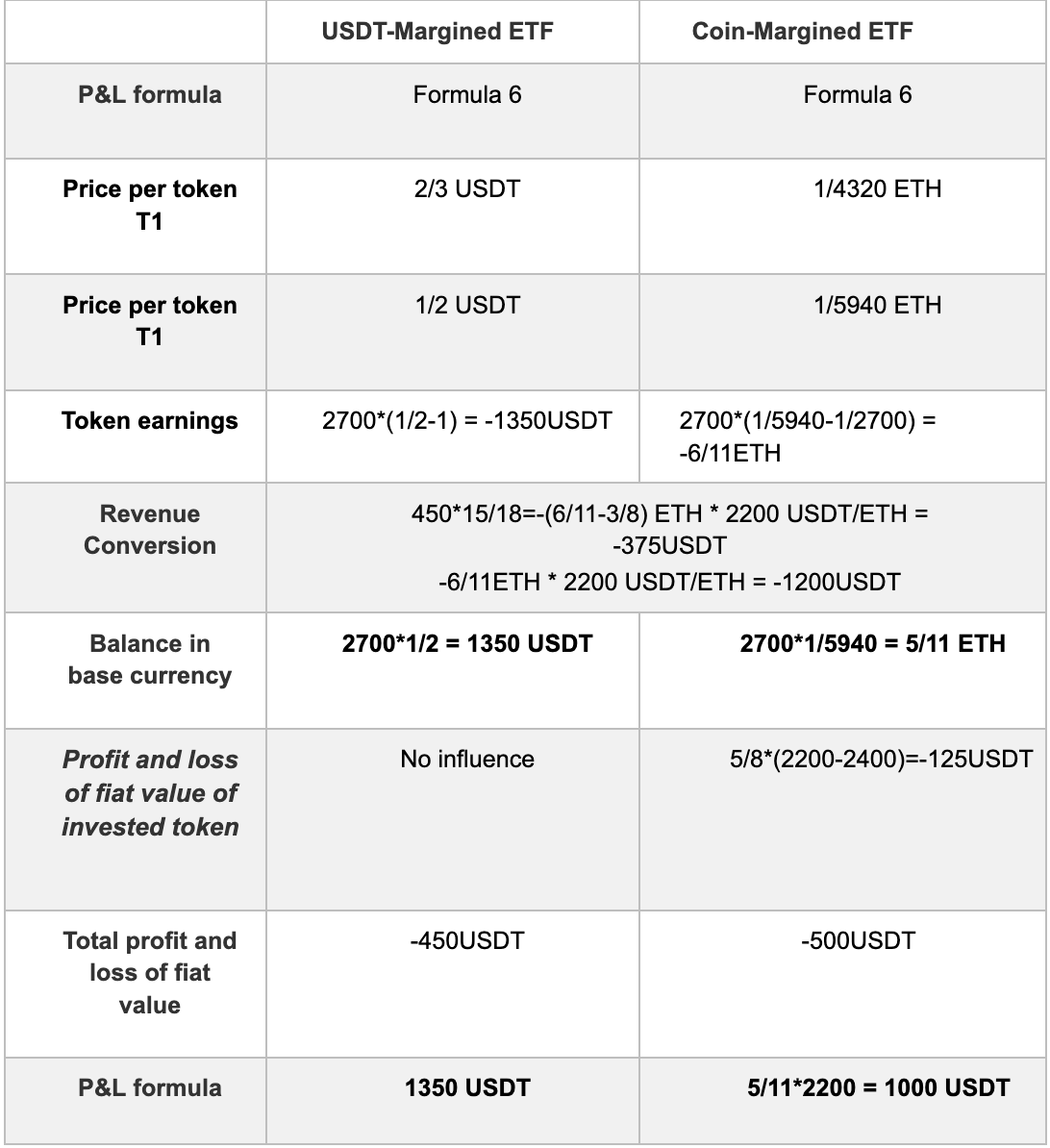

Case 4 The Wrong Position Situation

Assuming 1 USDT = 1 USD, at ETH price of 2700 USDT, 3L token price is 1 USD

Coin-Margined ETF: purchase 2700 3L tokens at the price of 1 ETH (number = 1*2700/1=2700).

USDT-Margined ETF: purchase 2700 3L tokens at the price of 2700 USDT (number =2700/1=2700).

Assuming ETH price drop of 1/9 ($2,700 to $2,400), then the token price drops by

1/3 under USDT-margined ETF and 3/8 under Coin-Margined ETF. The revenue comparison is as follows:

It was found that both positions were losing $900, but due to the fall in the price of the coin, the coin-margined ETF not only lost 3/8 of ETH, but also reduced the total profit and loss of the fiat currency value by $300.

Case 5 The situation triggering rebalancing

In Case 4, the coin price falls by 1/9 and the 3L product falls by 1/3, triggering a rebalancing.

Following the scenario of Case 4, where 1 USDT = $1, at ETH price of $2,400 and 3L token price of 2/3 USD in the USDT-Margined ETF and 1/4320 ETH in the Coin-Margined ETF.

Coin-margined ETF: continues to hold 2,700 3L tokens.

USDT-margined ETF: continues to hold 2,700 3L tokens.

Assuming that the ETH price continues to fall by 1/12 ($2,400 to $2,200), the token price is determined to fall by 1/4 ($2/3 to $1/2) in the USDT-Margined ETF and 3/11 in the Coin-Margined ETF ($1/$4,320 ETH to $1/$5,940 ETH) based on the new anchor price.

The comparison of returns is as follows.

At the time of rebalancing, although there were 2700 coin-margined ETFs, which were worth 5/8 ETH, the fiat currency was only worth $1500. While 2700 USDT-margined ETFs were worth $1800. The initial investment was different between the two products, so the conversion of returns within this range should be multiplied by the initial value ratio of 15/18.

It was found that in both positions equivalents lost $375, but the coin-margined ETF lost 15/88 due to the fall in the price of the coin. The coin-margined ETF lost 15/88 ETH and also reduced the total profit/loss in fiat currency value by $125.

Case 5 demonstrated that since the generation mechanism of token price already takes rebalancing into account, the profit and loss calculation only needs to know the price of the base currency and token when entering and exiting. Whether rebalancing occurs or not does not affect the profit and loss calculation.

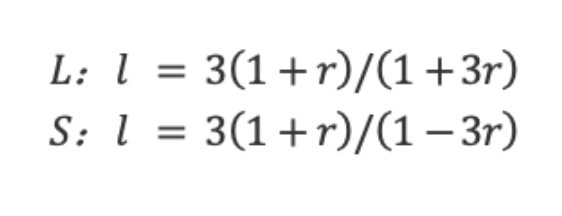

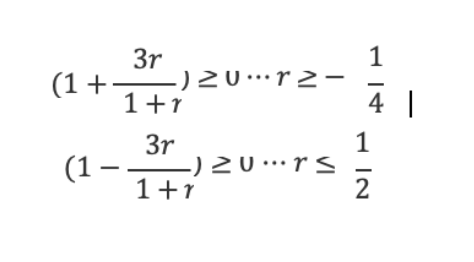

- 4. Leverage Trigger Ratio

Under the coin-margiend standard, the price of ETF tokens changes differently than under the USDT-margiend standard (see Formula 5 for details). As a result, they have different leverage depending on the price of the coin.

Under the USDT-Margined standard: Formula 8

Under the Coin-Margined standard: Formula 9

Note that in a short position there is a difference between the position held short and the net value. At some point, there will be a situation where the net value goes up and the position goes down. Therefore, for short positions, it is also necessary to use their position (1+r) rather than the net value (1-r).

Coin-Margined ETFs are at higher risk of blow up when confronted with extreme market conditions. Blow up ratio: Formula 10

3L will blow up at 1/4 of the coin price moving in an unfavorable direction, while the USDT-margiend position requires 1/3.

3S will blow up if the coin price moves 1/2 in the unfavorable direction, while the USDT-margiend position requires 1/3.

It is found that If the USDT standard is specified, rebalancing is always triggered when the favorable direction changes by 1/3 and the unfavorable direction changes by 1/9. This is not the case under the coin-margined standard.

For long products, rebalancing is triggered at 1/5 of a change in the favorable direction and 1/13 of a change in the unfavorable direction; for short products, rebalancing is not triggered at 1/5 of a change in the unfavorable direction.

Clearly, a currency-margined ETF is at greater risk of blowing up in the face of extreme conditions and will trigger rebalancing more often.

Disclaimer

Coin-Margined ETF is an emerging financial product. The content above does not constitute investment advice. Please watch out investment risks.

Coin-Margined ETF reduces the risks of liquidation, but in extreme conditions there’s possibility that the price will approach zero and be liquidated. Please pay attention to the difference between order price and net value, to avoid losses.

Comments

0 comments

Article is closed for comments.