1. Overview

- Hotbit Leveraged Index Product selects spot assets of good liquidity as underlying assets and determines their weightings in the initial benchmark market capitalization based on the proportion to their daily average trading volume in the last month. As such, it can reflect the overall performance of the asset class.

- Leveraged index 's underlying assets are selected based on sector, popularity, liquidity, and etc. A single leveraged index product will contain no more than 20 underlying assets.

- Our first leveraged index product will be Defi Index, which is constructed by elements chosen from the Defi sector.

- Leveraged Index product, like spot trading, can be seen as s special cryptocurrency which takes USDT as the price unit.

- Take the example of Defi 3-times long product, of which the name is Defi 1Day 3x Long,with its abbreviation being DEFI1D3L. Also, for Defi 3-times short product, the name of the product is Defi 1Day 3x Short, with its abbreviation being DEFI1D3S.

2. Features

- Unlike other index products in the market, Hotbit's Leveraged Index product uses financial derivatives and debt to amplify the returns of an underlying asset, which is an index. It aims for a 2:1 or 3:1 ratio. For example, if the underlying asset rises 1%, the corresponding 2x or 3x leveraged index rises 2% and 3% respectively, while the -1x and -2x products falls 1% and 2% respectively.

3. Underlying Index Construction Method and Calculation Formula

- Every unit of our leveraged index product reflects a corresponding share of the underlying assets, which are used to construct the index. We will list the net value per share as well as the market trading info in case the current strike price deviates from the net value.

- When an investor purchases certain shares of leveraged index product, fund managers will purchase a certain value of spot assets that match the leverage. The net asset value is calculated by the cost of spot purchase.

- To help investors better understand how weighting and assets are configured, we will weigh the 10 assets equally as Defi Index goes online: that is, each underlying asset will have an initial weighting of 0.1. And the weighting will be calculated according to the index calculation formula since the first re-adjustment.Hotbit will adjust the index components and their weightings every 30 days with the issuing date as the benchmark time. Hotbit will remove the index samples of high risks that no longer meet the sample selection criteria and take the adjustment date as the benchmark date to recalculate index price and index net value. Normally, Hotbit will adjust the weighting of the index samples based on their daily circulating trading volume in the last 30 days.

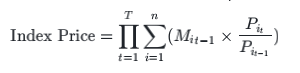

- Hotbit Index Product Construction Method and Calculation Formula

-

- t0 :the benchmark time in construction of the index;

- tn : the latest time of the index Product;

- M(t ) : benchmark price of the index Product at the time of 0 t0

- M(tn) : the price of the index Product at the time of tn ;

- Pi(t0 ) : the trading price of the i underlying asset at the time of t0 ;

- Pi(tn) : the trading price of the i underlying asset at the time of tn ;

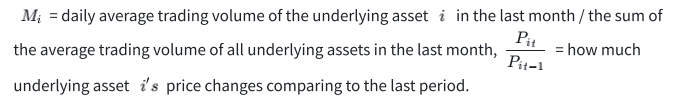

- the initial market cap weighting of the underlying asset at the time of =daily average trading volume of the underlying asset in the last month / the sum of the average trading volume of all underlying assets in the last month; (According to investable principle, the weighting will be adjusted manually in reference to the daily average trading volume)

-

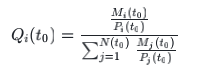

Qi(t0 ) : the price weighting of the i underlying asset, :

-

N(t ) is the number of underlying assets in different period

-

One index will contain no more than 20 assets, so that i ≤ 20

-

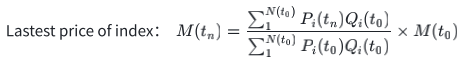

The formula above could be simplified to:

-

4. Configuration of Defi Index

- After reviewing underlying assets’ market cap, trading volume, liquidity, fluctuation,stability, risks and market assessment, Hotbit chooses the following 10 cryptocurrencies to configure the Defi Index:GRT LINK UNI AAVE SUSHI CRV COMP YFI SNX 1INCH

5. Re-adjustment overview

- When a new product debuts, weighting will be calculated as: Example: If Defi Index attributes to 10 underlying assets, i = 10, then each element has an initial weighting of 1/10 = 0.1.

- a.Mi(t0) = 1/i,i = underlyingasset

- b. Re-adjustment takes place every 30 days with the issuing date as the benchmark time.

- c.Due to the volatility of the cryptocurrency market, we will re-adjust the configuration of underlying assets at each benchmark time to ensure our index reflects the market trend more precisely.

- d.At the first re-adjust, underlying assets' weighting will be calculated according to their

average trading volume in the previous month.

- e.Hotbit will remove the index samples of high risks that no longer meet the sample selection criteria and take the adjustment date as the benchmark date to recalculate index price and index net value.

6. Rebalance Mechanism of Leveraged Index Product

- Similar to leveraged ETF products, we will conduct regular rebalance on the investment portfolio underlying the leveraged index products so that the rate of the portfolio’s leverage will not deviate too much from the rate stipulated by the agreement. Normally, we will conduct rebalance on the positions of the products every 24 hours at UTC 2:30 AM.

- In case drastic fluctuations occur, comparing with the previous point of rebalance, if the fluctuation range of the subject’s assets exceeds the designated threshold (the threshold a.may vary in case Hotbit launches other products at other times), we will also conduct temporary rebalance for the elimination of the risks of the investment portfolio. The temporary rebalance is only targeted at the party that suffers from the loss caused by the drastic fluctuation . For example, in case that the value of Defi index increases by 15%, we will conduct rebalance on DEFI1D3S product only, and not on other products.

7. Leveraged Index Product Amalgamating/merging

- Similar to the leveraged ETF products, when the price of the net value of the product (eg: DEFI1D3L/DEFI1D3S) is lower than a certain threshold, the platform will conduct amalgamating operation on the product (which means that after the amalgamating operation, the new price of the net value will be 10 times of the previous price of the net value before the amalgamating operation, and the amount of the assets will also be changed to 1/10 of the amount compared with the amount of the assets before the amalgamating operation, so that the volume of the users’ total assets will not be affected at all) to improve the sensitivity regarding the changes in prices and optimize trading experience.

8. Trading Fee for Leveraged Index Product

- The trading fee rate of leveraged index product is the same as spot trading fee rate, that is 0.1%. Besides, Hotbit will charge management fee for each unit of leverage every day(usually between 0.2%~0.5%; the management fee rate is dynamic based on the performance of crypto market; exact management fee for each index product should be referred to the real-time page) to pay the funding rate, trading fee and other necessary charges generated by the fund portfolios. The management fee will be manifested on the dynamics of net value.

9. Q&A

- If one or more underlying assets are removed or added during re-adjustment, how is the new weighting and price calculated?

Starting at every re-adjustment, Hotbit will calculate each element's weighting according to its trading volume in the previous 30-day period. Specific methods and calculation can be found above.

- Will the weighting change in between every re-adjustment period?

Unless severe risk is observed in one or more assets, weighting will not change in

between re-adjustment periods.

- How to check the underlying index ?

All Hotbit users can view the current value of the underlying index in the exchange page for reference

Comments

0 comments

Article is closed for comments.