Q:What is Leveraged ETF?

A: A leveraged exchange-traded fund (ETF) is a product that uses financial derivatives and debt to amplify the returns of an underlying token. It often aims for a 2:1 or 3:1 ratio. For example, if the underlying token rises 1%, the corresponding 2x or 3x leveraged ETF rises 2% and 3% respectively, while the -1x and -2x products falls 1% and 2% respectively.

A leveraged ETF is essentially a fund managed by a professional financial team. Each ETF product corresponds to a certain number of futures contract positions. The fund manager can dynamically adjust the futures positions so that the entire fund share can maintain a fixed leverage for a certain period of time. A professional team is responsible for the management and maintenance of the investment portfolio, allowing investors to easily build their own constant leveraged investment portfolio without needing to understand the specific mechanism.

Q: How can the corresponding incomes of Leveraged ETF products be realized?

A: Essentially, leveraged ETF products itself are a type of fund managed by professional financial engineering teams, with each leveraged ETF product corresponds to a certain amount of futures contract positions. The fund manager can dynamically adjust the futures positions so that the entire fund share can maintain a fixed leverage for a certain period of time. A professional team is responsible for the management and maintenance of the investment portfolio, allowing investors to easily build their own constant leveraged investment portfolio without needing to understand the specific mechanism.

Q: What’s the subject of leveraged ETF products?

A: Our first leveraged ETF product traces the increase range of BTC. In the future, based on market status, we will also launch leveraged ETF products of other popular token types.

Updates:

ETH1D3S(1Day 3x Short)ETH1D3L(1Day 3x Long)

LINK1D3S(1Day 3x Short) LINK1D3L(1Day 3x Long)

ADA1D3S(1Day 3x Short) ADA1D3L(1Day 3x Long)

TRX1D3S(1Day 3x Short) TRX1D3L(1Day 3x Long)

XRP1D3S(1Day 3x Short) XRP1D3L(1Day 3x Long)

LTC1D3S(1Day 3x Short) LTC1D3L(1Day 3x Long)

YFI1D3S(1Day 3x Short) YFI1D3L(1Day 3x Long)

YFII1D3S(1Day 3x Short) YFII1D3L(1Day 3x Long)

YFV1D3S(1Day 3x Short) YFV1D3L(1Day 3x Long)

UNI1D3S(1Day 3x Short) UNI1D3L(1Day 3x Long)

Q; How can we purchase leveraged ETF products?

A: Leveraged ETF can be purchased by USDT.

Q: What’s the naming rules of leveraged ETF products?

A: Take the example of BTC 3-times long product, of which the name is BTC 1Day 3x Long, with its abbreviation being BTC1D3L. Also, for BTC 3-times short product, the name of the product is BTC 1Day 3x Short, with its abbreviation being BTC1D3S.

Q:Trading Fee of Leveraged ETF?(The actual rate is subject to the interface display)

A:The trading fee rate of leverage ETF product is the same as spot trading fee rate, that is 0.1%. Besides, HOTBIT will charge management fee for each times leverage every day (the management fee rate is dynamic based on the performance of crypto market. It is displayed on the leveraged ETF product trading page) to pay the funding rate, trading fee and other necessary charges generated by the fund portfolios. The management fee will be manifested on the dynamics of net value. It is only charged at 10:30 (Hong Kong time). No fee will be charged if you do not hold Leveraged ETF product at the time point.

Q: How to avoid liquidation? What is rebalance mechanism?

A: We will conduct regular rebalance on the investment portfolio underlying the leveraged ETF products so that the rate of the portfolio’s leverage will not deviate too much from the rate stipulated by the agreement. Normally, we will conduct rebalance on the positions of the products every 24 hours. In case that drastic fluctuations occur, comparing with the previous point of rebalance, if the fluctuation range of the subject’s assets exceeds the designated threshold (we have initially set the threshold that corresponds to 3-times long and 3-times short as 15%, the threshold may vary in case Hotbit launches other products with other times), we will also conduct temporary rebalance for the elimination of the risks of the investment portfolio. The temporary rebalance is only targeted at the party that suffers from the loss caused by the drastic fluctuation, for example, in case that the value of BTC increases by 15%, we will conduct rebalance on minus 3-times leveraged ETF product only, and not on other products.

(Risk Warning: In case any users misjudge the market trend, in extreme situations, certain risks regarding the fact that the price of the product may decline to nearly zero may involve)

Q:What are the characteristics of ETF?

A: Similar to futures contract products, leveraged ETF products are derivatives with leverage effects, which can amplify investors' returns and become a cheap risk hedging tool. However, compared to futures contracts, leveraged ETF products have the following unique characteristics:

(1) Similar to spot trading with no margin required: users can trade this leveraged product just as they would trade a spot product.

(2) No risk of liquidation: Due to the inherent characteristics of leveraged ETF products, we will regularly rebalance the fund's investment portfolio, so investors do not need to worry about the risk of liquidation.

Q: What’s the similarities and differences between leveraged ETF products and futures contract products?

A: Just like futures contract products, leveraged ETF products are also derivatives with leverage effects that can expand investors’ incomes and thus becomes an economical tool for risk hedging. Compared with futures contract, leveraged ETF products involve the following unique features:

No deposit required, and no risks of liquidation (Risk Warning: In case any users misjudge the market trend, in extreme situations, certain risks regarding the fact that the price of the product may decline to nearly zero may involve). For those investors who are too busy to concentrate on market fluctuations, the purchase of leveraged ETF products greatly saves their time and energy.

Fixed times of leverage. For futures holders, the times of the leverage of contract positions may vary according to the changes of the assets’ prices, which may deviate from the original intention of the investor. For example, the investor establishes a short futures position with low leverage, but when the price of the asset greatly increases, the times regarding the leverage of of the investor’s position will become very high, which thus deviates from the investor’s original risk preference. On the other hand, the mostly fixed times of leverage of the product allows the investors to follow their own investment plans more consistently.

Q: What’s the similarities and differences between leveraged ETF products and leveraged spot trading?

A: Compared with leveraged spot trading, leveraged ETF products do not require deposits either, and there is no risks of forced liquidation involved. Also, compared with the cost regarding the interests of the assets of leveraged spot trading, the cost for holding leveraged ETF products is even lower.

Q: What is unit net value? What’s the difference between unit net value and price?

A: As a fund product, each unit of leveraged ETF products correspond with relevant fund shares, and the dynamic actual value of the share is the unit net value of the leveraged ETF products. Considering the fact that the product is also involved in the active trading activities on secondary market, the latest transaction price may deviate from the unit net value. Hence, we list both the unit net value and the latest transaction price, and hope our investors will realize that your purchase / selling price should not deviate too much from the unit net value, as otherwise, theoretically, you will suffer from relevant losses. Meanwhile, when the price of the net value of the product is lower than a certain threshold (initially, we set it as 0.05 USDT), the platform will conduct amalgamating operation on the product (which means that after the amalgamating operation, the new price of the net value will be 10 times of the previous price of the net value before the amalgamating operation, and the amount of the assets will also be changed to 1/10 of the amount compared with the amount of the assets before the amalgamating operation, so that the volume of the users’ total assets will not be affected at all) to improve the sensitivity regarding the changes in prices and optimize trading experience.

Q: What type of investors are leveraged ETF products suitable for?

A: As a type of products that has been tested by traditional financial market, leveraged ETF products are suitable for most investors, especially for those investors who believe that certain market trends will occur and be reflected in the price of the assets and those investors who are not willing to undertake the risks of forced liquidation. Considering the fact that certain management fees apply to the products and the leveraged ETF products themselves involve certain features, relatively huge losses of the products may occur under the market trend of repeated fluctuations.

Example 1:

Take the example of 3-times BTC product, in case that the daily market trends of BTC within 4 days are +10%, +10%, +10%, +10%, then the rate of 4-day income of the product will be 185%, which is more than 3 times of the rate of 4-day income of BTC spot trading; in case that the daily market trends of BTC within 4 days are -10%, -10%, -10%, -10%, then the rate of 4-day loss of the product will be 76%, which is less than 3 times of the 4-day loss of BTC spot trading; in case that the daily market trends of BTC within 4 days are +10%, -10%, +10, -10%, then the rate of 4-day income of the product will be -17%, which means that the loss will be more than 3 times of the loss of 4-day BTC spot trading.

Example 2:

In case that the daily market trends of BTC within 100 days follow the pattern of +10%, -10%, +10%, -10%......., then the rate of income of BTC 3L and 3S products will be -99.1%, which means that the risks regarding the fact that the price of the net value may decline to almost zero may occur in this situation.

Example 3:

In case that the price of BTC continues to increase within the first 10 days and accumulates a total range of increase by 200%, then continues to decline within the next 10 days afterwards and accumulates a total range of decrease by 200%, then the risks regarding the fact that the price of the net value of BTC 3L and 3S may decline to almost zero may occur, and during this process, the “amalgamation of shares” mechanism will be triggered to guarantee volatility.

Apart from that, under other extreme market trends with extreme fluctuations, for example the price continues to skyrocket or that the price continues to plummet, the risks regarding the fact that the net value of 1D3L and 1D3S products may decline to almost zero may also occur.

Q:How to purchase Leveraged ETF?

A:the users can purchase leveraged ETF product in the ETF area like others token/coin.

Q: When will leveraged ETF products be merged?

A: when the net value of leveraged ETF products is lower than 0.1 USDT, the Share Merging Mechanism will be triggered. Merging can improve price change sensitivity and optimize user's trading experience. At the same time, we will issue an official announcement before each merger to inform users that the leveraged ETF products will be merged soon.

Q: Will I lose funds in my ETF account after the merger?

A: No. After merging, the number of users' existing assets will be multiplied by 0.1, and the price will be increased by 10 times. So the total assets of users will not be affected after the merge.

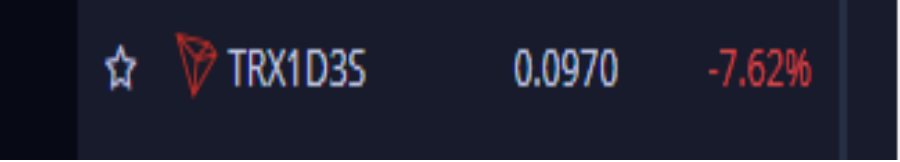

Take TRX1D3S as an example

Suppose John's account has 100TRX1D3S worth 9.7USDT at the time of the merger, then after the merger is completed, his asset quantity will become 100TRX1D3S*0.1=10TRX1D3S, the value is still 9.7USDT. Hence, the merger will not result in any loss.

Q: Why did the leveraged ETF products I hold have increased greatly, but the value of my assets has not increased?

A: If the ETF product has increased significantly, but the value of the ETF product asset you hold has not changed, it may be because the increase is caused by the merging and is not caused by market fluctuations, so it is not for reference. You can check the annoucement or check whether the amount of account assets has been multiplied by 0.1 to check whether the currency has triggered the merger mechanism to merge.

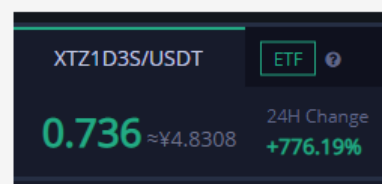

Take XTZ1D3S as an example

John had 100XTZ1DS3 worth 70.49USDT before XTZ1D3S merger, and after the merger, it became 10XTZ1D3S, still worth 70.49USDT. But he saw that the XTZ1D3S interface showed an increase of +776.19%, but the value of his assets did not increase according to the increase, so he thought his assets had lost. This is wrong, because the increase is to ensure that the merged user's assets will not be lost, so the increase is not part of the market fluctuations, so it does not have reference.

Investment risk tips:

Leveraged ETF is a tradable product that tracks three times the daily profit of underlying assets. Users shall pay attention to the gap between the actual net value of the product and the latest price when placing an order. If you put the order in the opposite direction, there is a risk that the price will approach zero in extreme conditions. This product subjects to the derivative with high risk. Please watch out the risk in investment.

Comments

0 comments

Article is closed for comments.